The concept of a “barn door” is one that conjures up images of rustic chic and a more simple life. While the appeal of an old barn door is undeniable, they’re not always the easiest thing to use or the most practical for a given situation. Fortunately, there’s plenty of sliding door kits out there that have a similar functionality to an old barn door, but also have advanced safety features and modern styling.

Your barn door hardware is one of the most important components of your barn door.

At a certain California company, each piece of barn door hardware is made to match your exact specifications and finishing needs. That’s right: whether you are seeking out the most utilitarian option or the latest trend, they carry a great selection of Sliding Door Hardware that will match your specifications and finishing needs.

You may need more depending on the size of your project and the look you want to achieve.

The best part about barn door pulls is at any time, if you decide your style changes, you can switch them out for a new one.

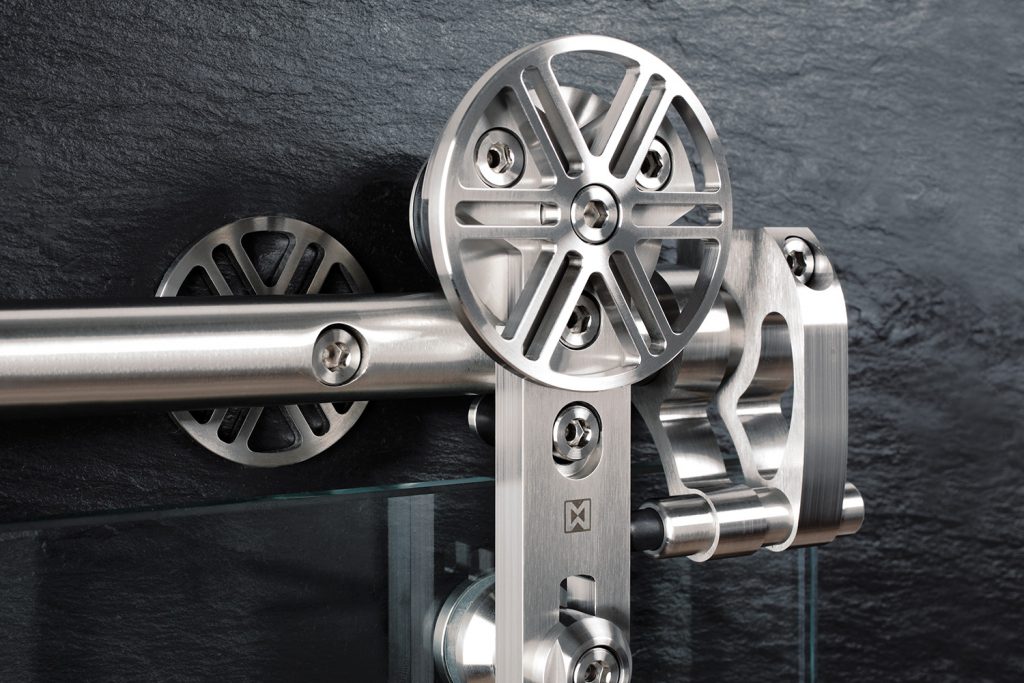

Modernized Barn Door Hardware with Safety Features

Don’t you hate to have a door that slides nice and smoothly across the rail, but find that there was nothing touching the ground to guide it and it could easily be pushed back and forth, hitting the wall – and also because it was not 100% level it wanted to slide shut on its own?

Interior only Modern Sliding Door Hardware Suppliers kits are made with few nylon parts to quiet the slide or make for easier adjustments in the kits.

The basic design allows the door to be the star of the show but you can add a bit of style with different hanger styles.

Most handles and pulls are easily installed by screwing the handle or handle plate into the desired height of your door panel.

The track design is essential for a barn door to make sure it does not swing or hit the wall.

First you must decide the kind of application in which your door will be used.

Barn doors are a common choice for adding privacy to a single doorway or a large opening between rooms.

Made-to-order barn doors save the work. They are easy to install, and you’ll be less likely to need something like a saw.

You will need the dimensions of the opening for your door and the distance from the top of the opening to the ceiling to ensure the appropriate hardware is chosen.

You can choose an American or European-made store with any style you want, and a variety of access configurations.

Flat Track Barn Door Hardware with Soft Close has many special features that are so useful that if you ask a reputable barn door hardware store specialist, chances are you’ll find exactly what you are looking for. For handling large doors of great heft, you will not find a better value on the market than their precision-designed Heavy Duty Sliding Barn Door Kits.

Stainless steel barn door hardware will compliment and easily enhance most interior design and decor styles.

The barn door will slide back and forth no matter whether you choose to install a handle. By just simply moving the handle in one direction, a flush door pull will allow your door to open.